One of the Modi government’s biggest reforms was also one that was done very quietly. This was the Insolvency and Bankruptcy Code Bill, which has forever changed India’s business model from one of crony capitalism to a rule-based regime.

So, first of all, let me splash the latest piece of good news.

ArcelorMittal is set to return Rs 7500 crore to SBI. No wonder then that the chairman of SBI is relieved.

What happened here requires some explanation. As the Prime Minister has recently mentioned on several public platforms, the total amount of loans given by banks in the ten years of UPA (2004-2014) was a whopping 34 lakh crore. That’s near twice the 18 lakh crores lent by Indian banks all the way from 1947 to 2004.

A significant chunk of the loans that the UPA handed out like candy has now gone into default, leaving the nation with a crippling NPA mess. The Prime Minister likes to refer to the UPA years as times of “phone banking” when big businesses would get “naamdars” to call up public sector banks and force them to give out these loans. Remember that when these loans went into default, it is we the people who got stuck with the bill.

The biggest single reform that Modi sarkar brought in order to end crony capitalism was the Insolvency and Bankruptcy Code Bill, 2016. In simple terms, the bill created a time-bound mechanism by which creditors could go after a loan defaulter. If the defaulter is unable to pay within a fixed period (usually only 6 months), they lose control of their company. Their assets are seized and auctioned.

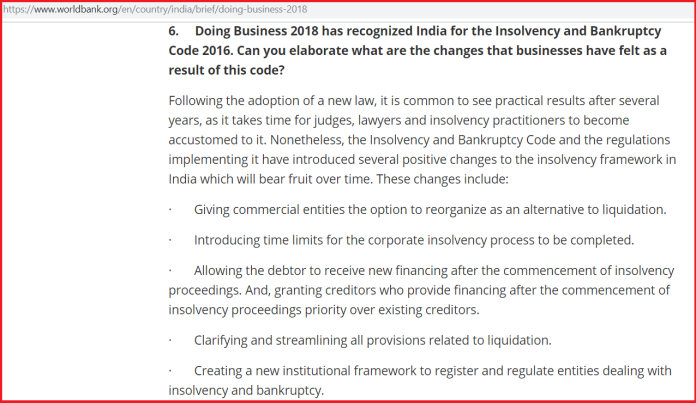

In fact, India is one of the few countries in the world to have a time-bound mechanism for resolving corporate debt. This is why the World Bank was all praise for India’s IBC code while announcing India’s sharp jump in Ease of Doing Business earlier this year.

So what happened with ArcelorMittal here?

The matter pertains to Essar Steel, a company saddled with massive debt, which is set to be auctioned off. Now, several companies would like to buy Essar Steel and Arcelor Mittal is among them.

This corporate tale reads like a fascinating thriller cum detective story. Except there is one twist. Remember that *we* the people are on the line for all the loan defaults.

First, Essar Steel gets listed as one of RBI’s ‘dirty dozen’ companies, i.e., companies that are sitting on a mountain of bad loans.

So, Essar Steel is put up for auction. But then, the government learns something shocking.

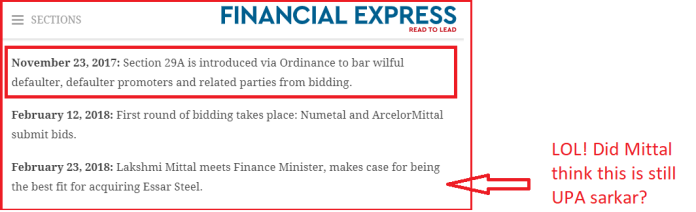

Essar Group was trying to buy its own company back at the auction, effectively discharging its defaulted loan AND buying back the asset at a rock bottom price. The next day, Modi Cabinet swung into action and rushed through an ordinance to stop this.

NO! As a defaulter, Essar is prohibited from bidding. And no using “related parties” to get around the rules either.

Two bids come in: one from Russian Steel major Numetal and another from Arcelor Mittal. And Lakshmi Mittal, who may or may not be aware that the UPA era has ended, decides to “meet the Finance Minister” in order to “explain” why ArcelorMittal is the “best fit” for acquiring Essar Steel.

Ha! Meeting the Finance Minister was of no use. BOTH bidders were rejected.

The first bidder Numetal was rejected because it had some connection to Rewant Ruia, the son of Essar Group’s Ravi Ruia. Remember how Modi’s IBC prevents “related parties” from trying to buy back their own assets through the back door.

As for ArcelorMittal, they were rejected too, because they had some stakes in two other companies called Uttam Galva and KSS Petron that had defaulted on loans. Both companies moved the courts to save their bids, but it was of no help.

The law was absolutely clear. The first bidder Numetal was allowed to place its bid only *after* it severed ties with the Ruias.

As for Arcelor Mittal, they were asked to pay back Rs 7000 crore of loan default before they could bid for Essar Steel.

Cut to October. With their tails firmly between their legs, Arcelor Mittal has now agreed to pay back all their dues.

Now you see why SBI Chairman is so relieved. We should be relieved too. SBI was a public sector bank. This was our money.

This is not just the story of one company or business. There are dozens of defaulters lining up all across India to pay back the loans they defaulted on.

If you default on loans, you can’t do business. At least not until Modi is around. Now you have a good idea why the opposition desperately wants the chowkidaar out of office.

Modi sarkar is moving the country from crony capitalism to a rule based regime, the foundation of any first world country. The days of “meeting” the Finance Minister and sorting out matters are long gone. But those days could come back after 2019. You can see why a huge section of vested interests in this country and beyond would want those days back. It is we the people who stand between them and their good old days. Remember that it’s our money, after all.