(This post was first published in 2011 on this site, written by @thekaipullai. All references to time are as of that date.)

Vijay Mallya wanted the Indian Government to save his airline.

When Vijay Mallya, the self anointed King Of Good Times, maker of India’s most expensive calender, asks the Government of India to bail him/his airline out it will be the headlines. For, after removing all the marketing gas and gloss, effectively meant the king was broke.

So the inevitable arguments followed with Arnab Goswami taking the lead on prime time TV and Suhel Seth vehemently playing the devils advocate, to save his friend. And after sometime, the man himself came on TV, speaking Oxfordian English, telling us that

1. Kingfisher Airlines is hale and hearty.

2. What he asked for is not a Bail Out, and how he is not Air India and will never ask the poor tax payer for his hard earned money to save his private airline.

And some more Mumbo Jumbo, basically selling us a load of nonsense that weighed as much as his yacht. But in reality, Kingfisher airlines is not in trouble. Saying Kingfisher airlines is in trouble is like saying Ra-One is just a bad movie. Kingfisher is right now at a stage, where being ‘in trouble’ would have actually been a good thing. It is actually having an existential crisis.

Figure this out

1. It has a total debt of Rs 7000 Crores, even after about Rs 1400 crores was kind of written off last year.

2. On top of this seriously large debt, the airline made an operational loss of Rs 1027 Crore over the last year. And the loss since its inception in 2003, a small matter of Rs 5690 Crores.

3. It owes a sum total of approximately Rs 890 crores to all its fuel suppliers. The situation with the fuel is so bad that Indian Oil has put a Kingfisher on a Cash and Carry basis. This means, they have to pay Indian Oil for every drop of fuel, before it actually goes into their planes and not afterwards, as is the norm. BPCL and HPCL, the other two suppliers, have stopped supplying fuel completely. BPCL has even filed a court case against Kingfisher Airlines for recovery on unpaid dues of over Rs 250 Crores.

4. It owes the Airports Authority of India, undisclosed landing charges. Their cheque of Rs 151 crores to clear their past dues, apparently bounced. And in a harbinger of further trouble, both the Bangalore and the Hyderabad airports have decided to ask Kingfisher for landing charges before they allow the KF planes to land. And if they do not clear their dues by the end of this week….

5. It has absolutely no assets that it can sell or mortgage. All its aircraft are currently leased, speaking of which

6. Kingfisher had to return its 5 ATR aircraft, the mainstay of its short haul flights, to its lessors as it could not afford the lease amount. With that, the sum total of aircraft returns since 2009 due to non payment of rent, increased to a total of 19. Also further aircraft recalls by lessors were on the way due to rental defaults.

The inevitable had to happen. Kingfisher, owing to lack of fuel, pilots, landing space or all the three, arbitrarily cancelled over 200 Flights (And the list is growing by the millisecond) without as much as a sorry, inconveniencing thousands of Indian air travelers, dealing a mortal blow to its image of a 5 star airline.

For anyone who says (Read the media and the man) this was due to the unfavourable combination of a hostile economic climate and high aviation fuel prices, please punch him/her in their faces. For Kingfisher is not down in the dumps because of those reasons. It has been pretty much in the dumps all this while. Kingfisher has been a loss making entity, since the day Mallya announced its launch in 2003. To put it in perspective, all his competitors, including the much maligned national carrier,Air India, were actually making profits, till as late as 2005-2006, while he sustained continuous losses.

So in one line, Kingfisher is an airline that is badly managed, has no assets to speak of (all their current Aircraft are leased and the ones they own are in an assembly line in Toulouse) and whose debts are mounting with every flight that either takes off or is cancelled.

And the man claims ‘all is well’ and as an ‘honest industrialist’ he will never ask for tax payers money. Why should he ask, when he in collusion with a particular minister with whom you will be introduced later in the post, surreptitiously has taken a lot of it anyway?

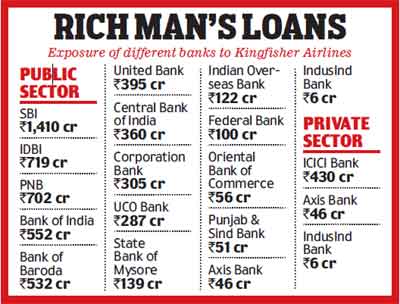

In fact he has not only gone after tax payer’s money, but also he has grabbed the money of the predominantly middle-class depositors who invested their savings in trusted public sector banks.

How did he pull it off? Read on

For this you, have to go back to 2010. As usual Mr Mallya was neck deep in trouble, with the banks circling around like vultures asking for the money that Kingfisher borrowed but could not or did not repay. So our man, decided to sit with the bankers, to ‘restructure’/reduce/waive off his debt. And the bankers obliged.

Kingfisher’s debt was reduced to Rs 6000 Crores,(type ‘debt recast’ in the find box) from the previous debt of Rs 8414 crores, when some of the debt was converted to equity. Banks took up a 23 percent stake in the Airline, with each Kingfisher Airline share being valued by the banks at Rs 64.48. The banks determined that 23 percent of the airline, at the above share price, was about Rs 1400 crores. This price was knocked off from the original debt. After that, both the bankers and Mallya went home happy and probably had a big party.

However, there was one small problem. Share price of Kingfisher Airlines, that day was, Rs 39.90.

This meant that, Mr Mallya was given an incredible premium of 61 percent premium per share in his failing company. I am not particularly strong in Maths, but then a quick back of the envelope calculation shows that,

According to banks, Rs 1400 crores of Kingfisher Airlines, represents 23.32 percent of the company when valued at Rs 64.48 per share. In reality however, a simple multiplication shows that, 23 percent of the company at that value is closer to around Rs 1000 crores, with the 400 crores being touted as the haircut taken by the banks. So the banks, which are under the control of the government of India, literally wrote off Rs 400 Crores, even after their generous calculation.

But, when you account for the real stock price at that time, which was Rs 39.90, 23 percent of the company was not Rs 1400 crores or Rs 1000 crores as determined by the banks.

It was, actually, somewhere close to Rs 461 Crores. The day the deal was signed, banks had decided to literally hand over Rs 1000 crores of depositor’s money to Vijay Mallya and his floundering airline. While Vijay Mallya claimed he had reduced his debt, which in essence was true, he had actually deprived the depositors and the banks of more than Rs 1000 crores.

The banks, to their defence, will say that as it is the price of a share and considering India’s potential in aviation, Rs 39 is a minor blip and the price will rise to its true value, which they determined as Rs 64, sooner rather than later.

It has been eight months since the deal was announced, and the highest stock price of Kingfisher in that period…Rs 48.85. Not once did it cross, the bank determined value. Not once.

As of today Kingfisher stock price has nosedived to Rs 23, rendering the value of the Kingfisher stocks that the banks have, to Rs 276 crores or so.

Vijay Mallya has swallowed, as of 21-Nov-2011, at least Rs 1200 crores of depositor’s money from various banks.

Add to the above straight up loss of Rs 1200 crores, the banks also reduced the interest rate of his left-over debt of about 7200 crores so that he could repay, as and when his lordship is willing. The exact figures of the reduction, I could not find, but when 1 percent of the amount represents 72 crores, it has to be pretty substantial.

And all this is depositor money, which translates to your money, my money and the money of pretty much anyone you will meet on the street.

And Vijay Mallya says, he has not taken and will never take tax-payers money.

However the fundamental question is, didn’t the banks realize that this is an almost insolvent if not a totally insolvent company they are dealing with? The facts were on the table, here was a company that has not made a profit since the day it was established. It has substantial unpaid bills in almost every sphere of its operations. Its debt was rising every day. And the global outlook on the aviation sector in general has been negative for the last few years.

So how could the bankers not only give Kingfisher Airlines a breather in its debts, but give it at an unheard of 60 percent premium guarenteed to cause them huge losses in both short and long term? Didn’t they realize it was not their ‘baap ka maal’ they were playing with?

At this point I can only speculate, but I am sure the decision was not Bank’s alone. I guess some higher power had to do with their largesse. Something akin to the

I give an order that you cannot refuse

I can only point you in the general direction of the man. He is a politician and before joining Indian politics, made his living by manufacturing Beedis. He is in fact India’s largest beedi maker, by a distance.

Just to give you a heads up on the man, let me quote one instance

Beedi’s are the considered the AK-47’s of the tobacco world. Though everyone assumes nuclear missiles are the weapons of mass destruction, it is the humble AK -47 assault rifle that is the real WMD. It is inconspicuous, easily available, very cheap and has killed more people in more countries than nuclear weapons ever can.

Similarly, a beedi is ten times cheaper, and going by the World Health Organization and Voluntary Health Association of India, it is smoked by eight times as many people who smoke cigarettes. Also according to them, the deaths caused due to beedis are more than the deaths caused due to the other tobacco products combined.

But when in 2010, Health Ministry decided to put pictorial warnings on tobacco products to warn people of their dangers, Beedi’s were miraculously exempted from necessary rule.

You don’t need to guess why that happened.

But what has this got to do with Vijay Mallya? Well turns out a lot

When Vijay Mallya’s Kingfisher Airlines flew its first flight on 9th May 2005, Kingfisher was ranked at number six in the pantheon of Indian Aviation, while Indian Airlines was in the second position, with Jet Airways at number one. Instead of concentrating on making his airline better, Mallya decided to push others out of the way in his quest for glory.

And he had a lot of help in doing that.

First obstacle, Capt C.R Gopinath, pioneer of low cost aviation and e-commerce in India and the guy responsible for the maximum number of first time fliers in India. Formidable force. Ensure that

1. He does not get landing space and hangar facilities in major airports.

2. Further permits to fly on profitable routes are denied.

All on orders from his guardian angel.

For added effect, Mallya unleashed a media barrage, targeting his airline labelling it a “Flying Udupi Restaurant” even when Air Deccan was making more money and carrying more passengers than Kingfisher. Capt Gopinath saw the writing on the wall and sold out to Vijay Mallya.

Obstacle 1, obliterated.

While this was happening, Subroto Roy Sahara, owner of Air Sahara, then the fourth largest operator also wanted to sell out. So, Vijay Mallya got into a bidding war for that heavily loss making and debt ridden airline, and using the Parthiban-Vadivelu auction strategy inflated the price for his competitor, the no 1 airline at that time. They fell for it and bought the airline at a price unanimously considered as too much.

Obstacle 2 dispatched, or that is what he thought.

And what happened to Vijay Mallya and Subroto Roy Sahara

Six Years later

However the most difficult competitor still remained Indian Airlines and Air India.

In 2007, Indian Airlines had a pittance of a loss of Rs 280 Crores. I say pittance because at the same time Mallya was seeing losses of Rs 480 Crores or so. And also, Indian Airlines had achieved profitability of over 90 percent of its routes and remaining 10 percent of the routes were on its way to green. So it was well on its way towards overall profitability. And Air India, was a actually a profitable airline.

And then the intervention happened

Completely disregarding the existing systems, policies and patterns of both the airlines, the powers that be, decided to merge IA and AI, ostensibly to increase their efficiency and allow it to enter the global Star Alliance. This according to them was the panacea for the non-existent ills of the national carriers. Why Star alliance only and why couldn’t Indian Airlines and Air India be members of that damned alliance on their own terms were trivialities that were not answered.

So suddenly, one loss making airline on its way to profitability and one just about profitable airline suddenly became one huge loss making airline. And this in spite of vehement opposition from the management of both the constituent airlines.

And to deliver the coup-de-grace to the shaken airline, the powers ordered a MIND BOGGLING 111 AIRCRAFT IN ONE GO. Yes a total of 111, that too at a mind boggling cost of Rs 32,000 crores. For apparently enhancing its operational capability. This when the management of Air India and Indian Airlines, the ultimate end users of the aircraft, had requested a sum total of 67 aircraft.

The inevitable had to happen. When your annual turnover is about Rs 7000 crore, how do you pay for aircraft worth Rs 32,000 Crores? You take a big loan, for which there is a big interest, Rs 6000 crore a year big.

What started as a loss of Rs 180 crore with a negligible debt, the new company suddenly had debts worth Rs 40,000 crores for which interest was mounting every day.

Main competitor taken care of.

It did not stop with that. Indian Airlines had specifically requested for Airbus A 340 planes, which were wide bodied and had a reliable delivery schedule. This was specifically mentioned in their requestion for new aircraft.

‘Indian Airlines, need 43 A 340-300 aircraft for their operations’ was the statement by their management. Unfortunately the statement was so unclear and complicated, that the powers to be just “read between the lines” and without any prior intimation or consultation, straight up changed the Request for Proposal (RFP).

So, the original requirement mandated that the new aircraft should seat six abreast which rendered both Boeing and Airbus eligible. This inexplicably was tweaked, with the new guidelines mandating the aircraft to seat nine abreast. As a result, Airbus was ruled out and Boeing suddenly was the only one in the race.

Also perhaps, in the RFP was a clause, that the aircraft should take as much time as possible for delivery. For the date on which I am writing, not one of the new aircraft from Boeing has been delivered, three years since the planes were ordered. All this while the debt incurred to buy them keeps accumulating day after day for Air India.

Air India was not being killed. It was being simultaneously poisoned, strangulated and stabbed. What more could one do to kill, what was once considered the national pride? Turns out, a lot more.

The powers now started meddling with Air India’s routes, to explicitly benefit Mallya and Kingfisher.

What the hastily arranged merger of the airlines, achieved was it had a direct effect on the agreements that the Indian Government has with foreign countries. For example, the agreement with Singapore allows a maximum of two Indian Carriers to fly at most 32 flights. The roles were being fulfilled by Air India and Indian Airlines, each flying 16 routes at about 90 percent capacity.

With both of them now being merged as one, it suddenly became one airline, opening the space for another airline to start flying to Singapore. And to enable that airline, the powers cut down 16 routes of the 32 flown by national carriers, so that the new airline join this highly profitable routes party immediately. You don’t need to be Einstein to figure out who filled in. In all, 16 profitable routes were lost to Kingfisher.

And while Air India continued to fly to Singapore, some domestic routes of Air India were cancelled outright, without as much as an explanation apart from ‘we need to cut loss making routes’ rigmarole.. And mind you, many of these routes had over 90 percent occupancies.

And exactly one week after these ‘loss making’ routes were cancelled, Kingfisher started operations on the same freaking routes.

Like the Mumbai-Vadodara: 90 percent load factor. Cancelled by Air India, patronized by Kingfisher

Kolkata- Bangkok- 90 percent load factor. Cancelled by Air India, Patronized again by Kingfisher

And also why does Air India, most of the times, have the most expensive tickets for peak flight timings,

Like here, here, here and here as well.

So to summarize

Excess Aircraft: Loss of Public money

Unnecessary Debt and resultant interest: Loss of Public money

Loss of Revenue because of arbitrary route cancellations and excessive pricing: Loss of Public money

All this was done to favour Mallya.

And Mallya claims he has not touched a paisa from the public.

In fact at the Air India inquisition, this was what a ruling cabinet minister had to say and I quote. “Reasons for going ahead with huge purchases by the civil aviation ministry despite Air India and Indian Airlines not having the capacity to support it, remain unknown to the Committee. It, therefore, recommends that this aspect needs to be further probed to fix the responsibility for taking such an ambitious decision that has become a big financial liability.”

When the Congress government starts pointing at you for corruption, you must have done something wrong.

It was Vijay Mallya’s strategy to drive everybody else to the ground, so that he could have a monopoly over air transport in India. And he had a faithful and willing ally at the peak of the aviation power pyramid, who did his bidding. It was as if, there was a grand plan to drive Air India to the ground, put it up for distress sale so that the leading bid could come from. You guessed it, Vijay Mallya.

What they did not account for was Mallya going belly up before that happens.

The systematic destruction of Air India and the Kingfisher bailout, should not be viewed in isolation. Both are closely related to each other. Mallya entered aviation, knowing fully well he had his friends in the seat of power. While they meddled with the Air India so that Mallya benefits, he grossly mis-managed his airline knowing fully well, come what may, he will somehow be saved in the end. With the Government ‘considering’ the bail out/loan/capital infusion application of Kingfisher, he might well be vindicated in his belief.

Scam Flowchart : For Future Reference

Truth be told, Mallya does not need a bail out. It will be a travesty if he is ever given one. Forget a bail out, all his debts should now be recovered on a priority basis, lest he pulls a Houdini and runs off somewhere. If he cannot pay, which I am sure he cannot, the government has to

1. Sell every asset of Kingfisher, or whatever is left (Whatever it has in terms of landing rights, Parking spaces etc etc)

if that does not suffice

2. They should confiscate his expensive collection of vintage cars

and if that does not suffice

3. Sell off his prime properties that he owns in UB City in Bangalore.

If that happens, no other tycoon will then take the Indian public or the government for granted and dare to mismanage their business with the belief that the government, with some inside help, will bail them out.

As of today, the total debt of Kingfisher, including pending fuel bills, landing charges, lease rentals totals to around Rs 10,000 crore and its total Market Capitalization is around Rs 1,220 crores.

Kingfisher’s debt, today is approximately 1000 percent of Kingfisher’s market capitalization. Which means, Even If I sell, all of Kingfisher’s shares, I will still have to about Rs 9000 crores of its debt left to be reclaimed.

9000 Crores

Do the banks still think Kingfisher will get their money back?

I will go on a cruise liner, sharing the president’s suite with Scarlett Johansson and Jessica Alba before that happens.

1. The weakening of Air India, also benefited other private airlines and some foreign carriers. No word is said about them because they did not go to the government with a begging bowl.

2. The financial calculations are approximate.

For some fascinating insights on the Air India scam, i redirect you to this amazingly informative piece.

And here are the entire transcripts of the Radia Tapes on the systematic destruction of Air India.